The Advantages of Opening a Local Currency Account for International Business

Any Singaporean firm that has tried to do business beyond borders would have experienced the hassle of receiving payments from abroad through international bank transfers.

It can be slow, complicated, and worst of all – expensive. With a cross-border transfer, firms’ receipts are badly affected in terms of the amount that actually reaches them, no thanks to transfer fees levied by multiple banks and sub-optimal exchange rate conversion rates. This forces Singaporean businesses to choose between a hole in their pocket or missed opportunities for international growth. Neither is an optimal choice.

If you are an SME in Singapore, here’s a way to do international business and extract the maximum value from payment receipts with local currency accounts.

International Wire Transfers: The Challenges

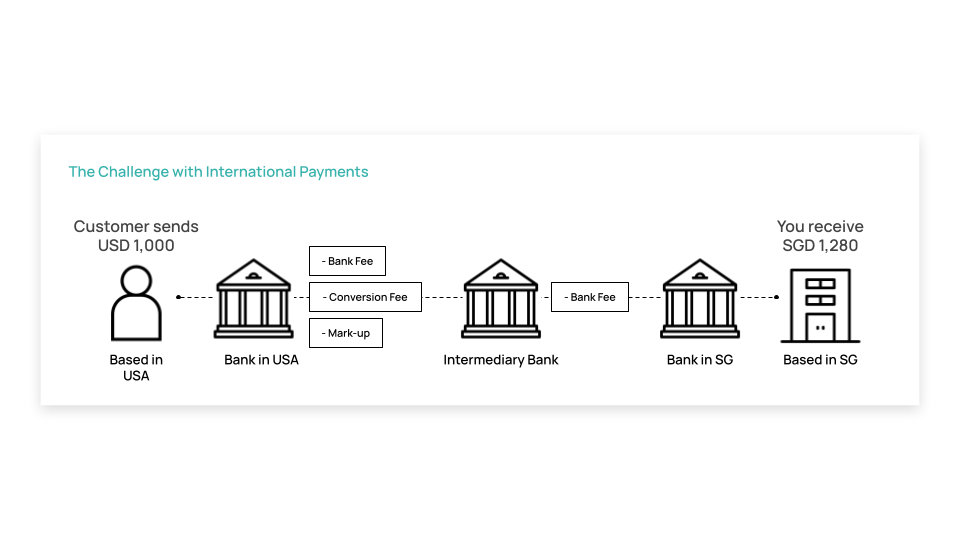

Before we get into a local currency account, let’s consider what really happens when you accept payments from a foreign customer, say in the USA, through international wire transfers.

Suppose you’re a Singapore-based manufacturer supplying electronic components to a mobile handset maker in Detroit, Michigan.

After you send every shipment, you raise an invoice and they pay you via an international bank transfer – from their bank in Detroit to your bank in Singapore. Each time, the transfer takes 3-5 days. Also, the amount you receive is much less than the amount you raised in the invoice and creates a nightmare when reconciling accounts receivables. Which invoice was it and whatever happened to the rest of your money?

All over the world, domestic wire transfers tend to be cheaper and faster since they can be completed through one payment system that’s provided by that country’s central bank. But an international bank wire transfer, in this case from the USA to Singapore, involves more parties, including banks and wire processing systems in both countries.

Here’s a quick tabular comparison of fees* charged by U.S. banks on one-time international wire transfers:

In general, sending banks will deduct some fees from the amount being sent by your customer. Your bank in Singapore will add its own charges. And if any intermediary banks are involved, they will add their own fees to the transaction.

In addition, there are other costs involved in international wires. Banks charge other banks a midmarket or interbank rate for trading foreign currency. But when these same banks convert money for consumers, they charge a higher ‘markup’, which is a percentage of the amount being sent. So even if your local Singapore bank does not convert your money for an international money transfer, the bank in the USA will definitely do it while charging its own markup. All these fees and markups can add up to a hefty sum – a sum that’s taken out of the payment you ultimately receive from your customer in Detroit.

The result?

They send USD 50,000, but by the time the payment reaches you, it’s a lot lower.

Local Currency Account: A Cheaper, More Convenient Option To International Bank Transfers

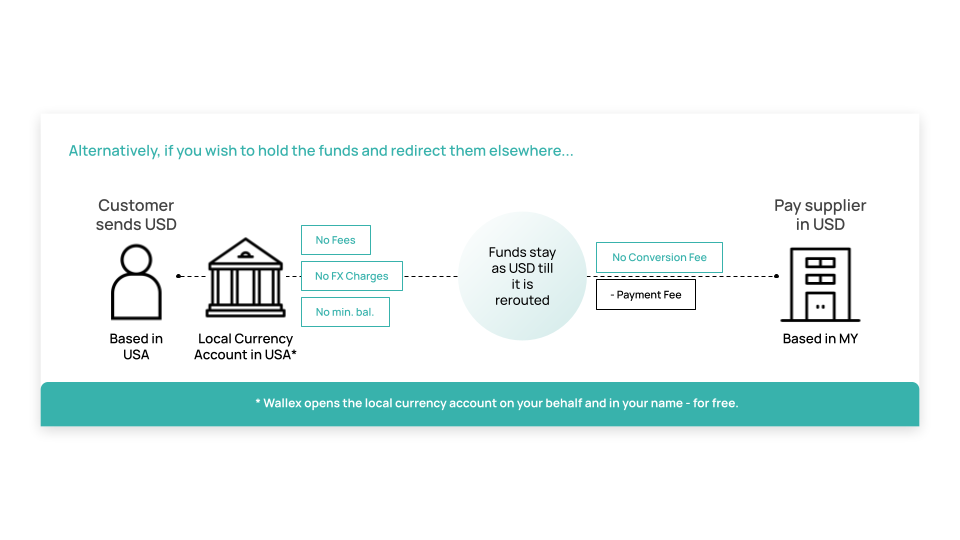

In simplest terms, a local currency account is an account that you, the Singaporean SME, can open in your customer’s country – in this case, the USA – to hold funds in USD.

Here’s how can a local currency account can help your business.

Currency pair of USD SGD indicates that how much US Dollar costs in Singapore Dollar currency unit

First, with a local currency account, your customer can pay you in their local currency, i.e. USD, without having to convert it into your currency, i.e. SGD. You can hold this payment in the account for as long as you like.

With a local currency account, you have the power to ‘hedge’ against currency fluctuations so you can move your money to your account in Singapore only when you need to, or want to, or when the USD/SGD exchange rate works in your favour. So if the exchange rate on a particular day means that transferring this money will give you a poor deal, leave it in the account. And if the exchange rate is favourable, move your money now, and use it later. Thus, keeping a local currency account eliminates the need for constant back-and-forth FX. As we showed in the previous section, every time you move money from one currency (USD) to another (SGD) via international bank transfers, you lose a little bit in the bargain. And these amounts can really add up over time, especially if you have a long-term relationship (or a contract) with the customer in Detroit.

At Wallex, rates are competitive, near mid-market and our fees are customisable according to your needs. This way, we tailor a package where neither party will be charged exorbitantly for making a transfer. You can extract the maximum value out of your international receipts.

Another benefit is that because your customer pays into a local account in his country, payments clear faster. This means you can also receive them faster. Payments will usually reflect in your account on the same business day (barring a few exceptions such as public holidays), so you don’t stress about delays, or waste time tracking the progress of your money.

The advantage for customers is that they have the convenience of settling your invoices in their local currency, while avoiding charges they would otherwise incur when making a cross-currency payment to your Singapore bank account. This makes you more competitive and your customers happier.

How does a Wallex local currency account work?

Singaporean businesses sometimes find it difficult to open local currency accounts in foreign countries, for reasons ranging from unfamiliarity with that country’s financial regulations, to a lack of available documents to open a bank account in that country.

Wallex simplifies this process for you, by opening a local currency account in the U.S on your behalf – for FREE. Open an account online and in seconds, without incurring any costs or going through any hassle.

Here’s how it works:

- Wallex opens a local currency account in the USA. All you have to do is provide some identification and verify your account.

- Share the account number with your customer when you send them an invoice.

- Your customer pays you the amount owed in their local currency.

- The amount reflects in your account in full, usually on the same day, or within 24 hours, whichever is earlier.

- Hold the amount in that account until you need it, or until you get a favourable exchange rate.

- You can access these funds to pay your foreign supplier in, say, Indonesia. At this point, the amount held in your local currency account in USD gets converted to IDR, and the amount (less FX conversion charges) reflects in your supplier’s account.

So, the only time FX conversion happens and you incur a cost is when you withdraw the money from your U.S. local currency account to pay another foreign entity. At the same time, this conversion happens directly from USD -> IDR (once) and not USD -> SGD -> IDR (twice). This is a huge advantage over international bank transfers, where FX conversions happen every time money moves between borders, at both the sending and receiving ends.

Wallex Local currency Account: A Simple, Cheap and Convenient Alternative to Foreign Bank Accounts

With a Wallex local currency virtual account, you can get paid with bank details from the US, Singapore or Indonesia – and operate as if you have a local bank account. You can accept these bank transfers as if they were local payments (USD/SGD/IDR), using the local clearing system. This gives you greater control over disbursements plus faster reconciliations as you expand your business to global marketplaces that require U.S., Singapore or Indonesia bank accounts to make payments.

Equally important, with this low-friction, low-cost method, you can avoid unfavourable exchange rates, and choose when you want to Wallet your funds or when to withdraw them. Wallex works closely with financial regulators and maintains the highest security standards to protect your data, your organisation and your money.

The account is also advantageous to your customers because it allows them to pay in their preferred currency and with their local transfer method, while eliminating international transaction fees.

Customers in Singapore can hold USD, EUR, GBP in three different local currency accounts, one each in the USA, Europe and the UK.

Sign up with a local currency account from Wallex for free. Get started here.

The Financial Lead Playbook

Tips for success to navigate the ever changing economic landscape

.png)