VC Firm BAce Increases Cost Efficiency and Speed of Delivery Using a Combination of Wallex Products

“Some startups have shared their experience about Wallex with us and they told us that it is literally a life-saving product in some cases".

Max Suyatno Samsir, SEA Investment, BAce Capital

Background

BAce Fund invests in technology startups and frequently needs to move a significant amount of investment funds to their beneficiaries in Asia. The funds originally reside in their bank accounts in the US. BAce previously used wire transfers through their banks in the US for moving money, until they switched to Wallex.

The Challenge

BAce found the Bank transfer process to be inefficient mainly due to 2 reasons:

- Long time for wires in and out, as funds were routed through intermediary banks

- Significant bank fees and especially high cost on small-amount wires due to bank commission fee.

The Approach

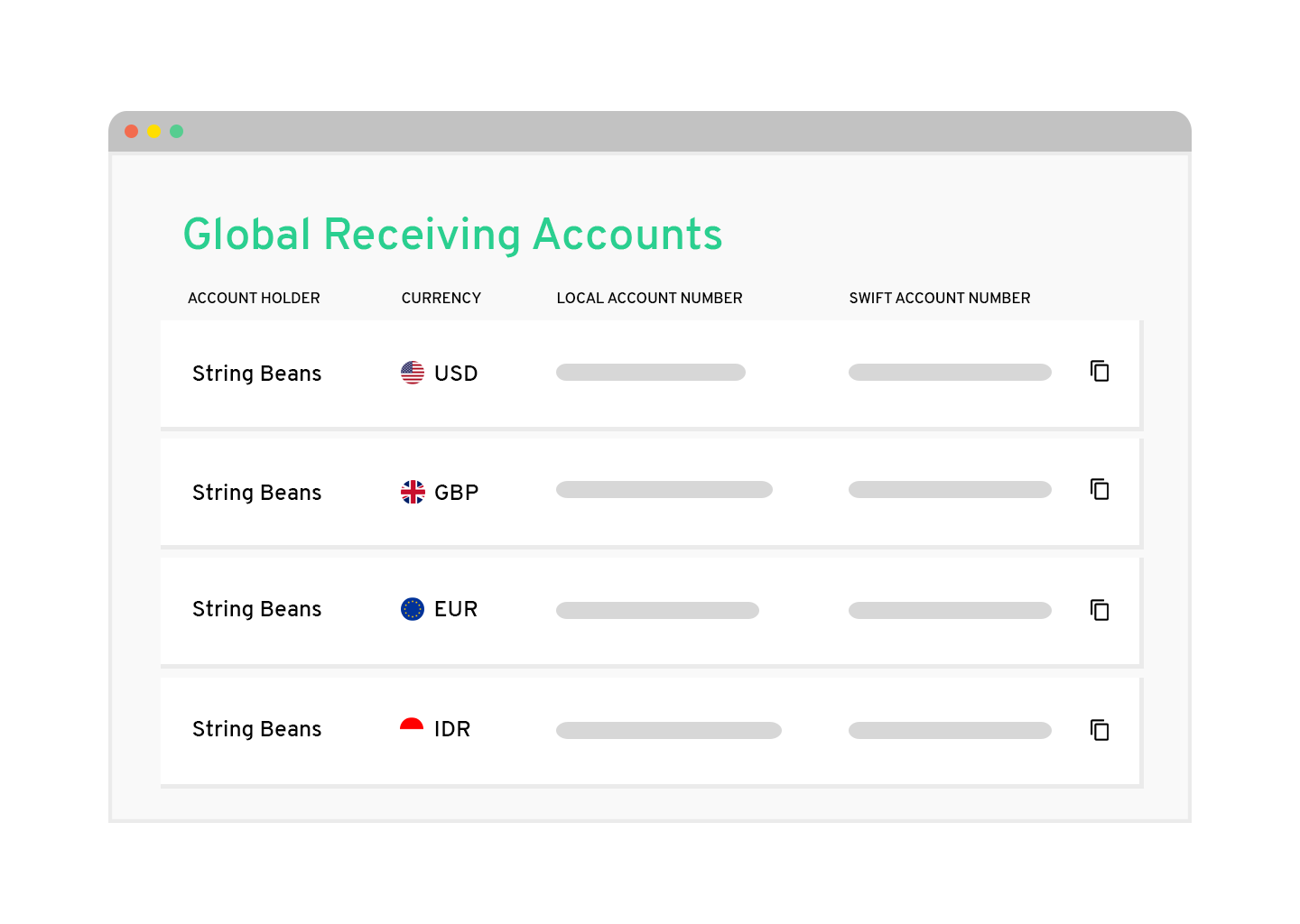

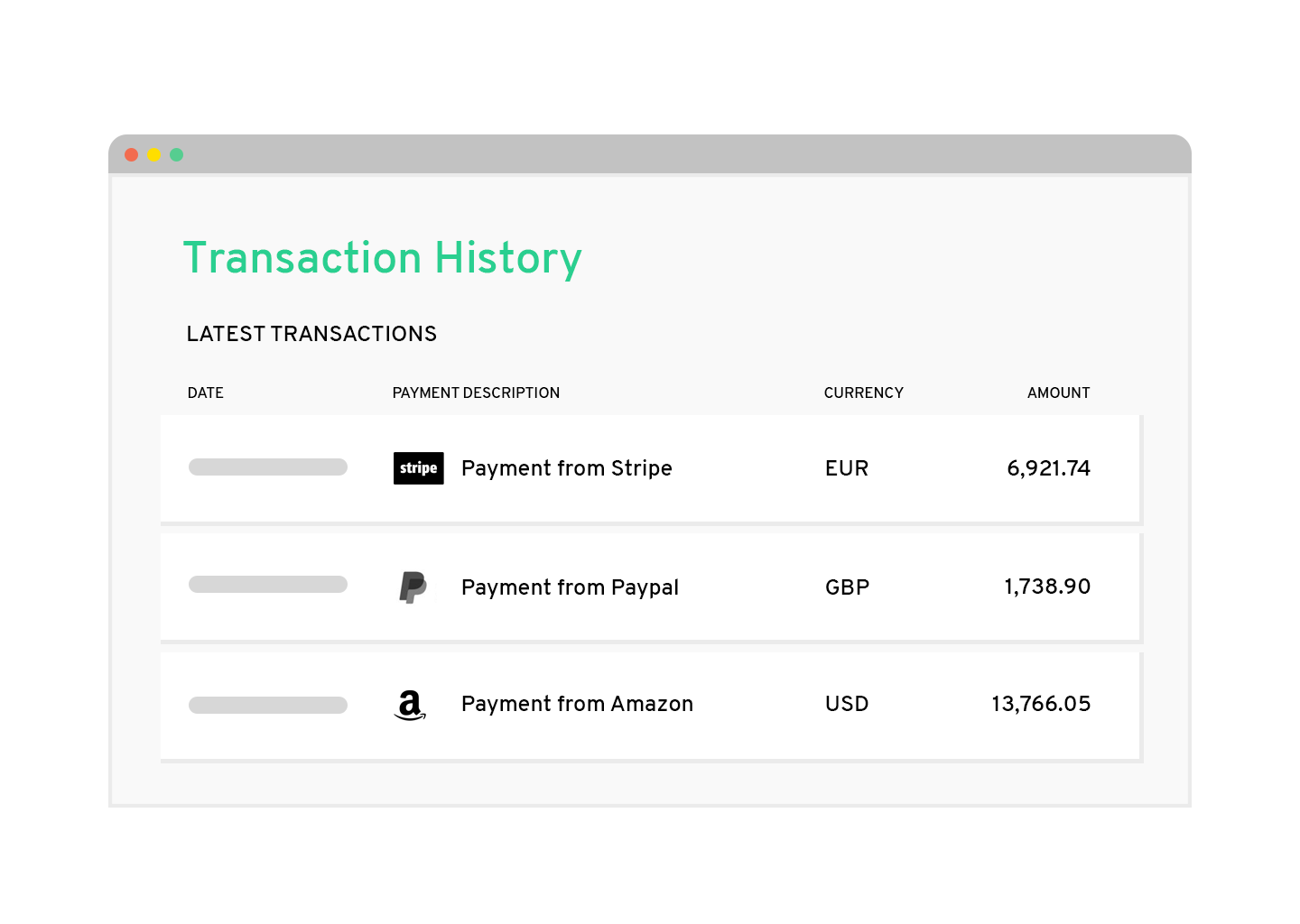

BAce signed up for a Wallex Business Account in Singapore. This enabled them to gain access to multiple services like low cost international payments, local currency conversions, multi-currency eWallet as well as receiving accounts in multiple currencies including USD - on a single online platform.BAce team then restructured the process to leverage Wallex's FX solutions to simplify the process of moving their money across borders.

Step 1: With the USD collection account activated, BAce is now able to make faster domestic transfers from their US bank account to the US collection account powered through Wallex. Receiving local payments into Wallex collections accounts are free of cost, thus the BAce team did not incur any charges for this.

Step 2: As soon as the funds are received in the collections account they reflect in their Wallex e-wallet balance in USD.

Step 3: BAce controls the exact time of making a local conversion from USD to the onward currency ( e.g. SGD) depending on when rates are more favourable to them. They also get access to very competitive FX rates from Wallex which are customised for their business volume.

Step 4: BAce pays out the funds to their local beneficiaries (e.g. in SGD locally in Singapore) from their wallet balance as a domestic payment, thus no international transaction charges are incurred by them or their beneficiary.The whole process can be completed within a business day with significant savings on costs as demonstrated above.

Key Results:

1. Savings of up to USD 2,000 per transaction

Wallex provides near mid-market exchange rates. Rates also locked in for 24 hours until the payment is funded to provide a further layer of contingency and protection in case the rate moves further up. Venture Capital like BAce usually have to make multiple cross-border transactions within a month with a variety of amounts - from big to small. Hence, being able to save USD 2,000 for every transaction is huge cost efficiency.

2. Saves up to 2 business days for USD - SGD transaction

With Wallex Collection Account, BAce able to make instant local transfers from their US bank account to their Wallex account without any charges. Using Wallex eWallet, BAce can hold their funds in USD and convert them into SGD to make payments to their beneficiaries in their preferred time in real-time. These combinations of Wallex robust products enable BAce to increase the speed and efficiency of their cross-border transaction.

3. Full control of when to perform currency conversion

Wallex enables BAce to strategically manage their exposure against inevitable fx market risk by having a full control of when they want to hold or convert their USD into SGD for payout.

4. Recipients don't incur any charges

When sending money across borders using banks or other providers, typically, the recipient will receive the payment minus the recipient bank's transfer charges. However, with Wallex, there would be no receiving cost incurred for recipients as it would be processed as a local transaction.

Globalise your business and simplify your payments with Wallex

Efficiency is crucial when it comes to corporate finance, especially for Venture Capital who need to make a frequent international transaction. Few dollars differences can result in either a huge loss or savings.

Get in touch with our FX expert and learn how Wallex can help you save time and money while you trying to scale up your business.

The Financial Lead Playbook

Tips for success to navigate the ever changing economic landscape

.png)